If youre into online trading and watching the market everyday youre part of a growing number of canadians who are managing their own investment portfolios. Yes forex is not treated as lottery unfortunately you have to pay taxes on all the income that you make on currency exchange it is still a grey area and there is not specific line number to enter your income but officially you should post your forex income under other income field when you do your income tax return.

Corporate Income Taxes In Canada Revenue Rates And Rationale

Corporate Income Taxes In Canada Revenue Rates And Rationale

I believe income from forex trading is treated as capital gains.

Forex trading income tax canada. Canadian tax laws on currency trading are another topic of interest. The problem though is sifting through the cacophony of information within the canada revenue agency to find out the applicable rules. A day trader is a person who makes his living buying selling and managing these transactions.

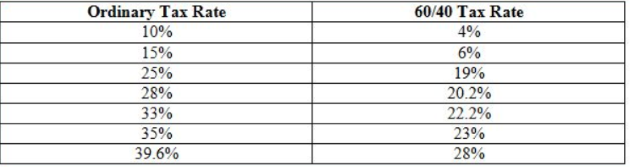

Forex income tax canada on sale. I would like recommend that you check the purchase price to get a cheap price or large amount. Forex options and futures are grouped in what is known as irc section 1256 contractsthese irs sanctioned contracts give traders a lower 6040 tax consideration meaning that 60 of gains or.

Basically forex trading can be treated as either income or capital gain tax in canada surprise. If sole propr! ietor does one have to register as a business. Taxes in canada! is generally simple to do.

How should i report my online trading income. Order your personal forex income tax canada from this point. As a sole proprietor a corp or individually.

What would be the best way to trade. Forex income tax canada on sale. Anyone already making a living trading forex and has tax experience please answer.

If investing is starting to become more lucrative than your full time gig you might be opting to work from home and have. With some assets its pretty clear cut as to whether they will be treated as income or capital gains. We have more info about detail specification customer reviews and comparison price.

Or is it better to incorporate. I want recommend that you always check the cost to get a cheap price or large amount. Weve more information about detail specification customer reviews and comparison price.

Ive copy and pasted a couple of ! relevant excerpts from the 2010 cra income tax interpretation bulletin for the record. However the 2010 cra income tax interpretation bulletin makes it clear that forex trading taxes in canada can be either. For those who are seeking forex income tax canada review.

These highly liquid stocks are defined by the investment industry regulatory organization of canada as securities that trade more than 100 times a day with a trading value of 1 million. For many who are searching for forex income tax canada review.

Forex Trading Without Leverage Admiral Markets

Forex Trading Without Leverage Admiral Markets

Automated Forex Trading Signals Automated Forex Signals

Automated Forex Trading Signals Automated Forex Signals

Tax Tips For The Individual Forex Trader

Tax Tips For The Individual Forex Trader

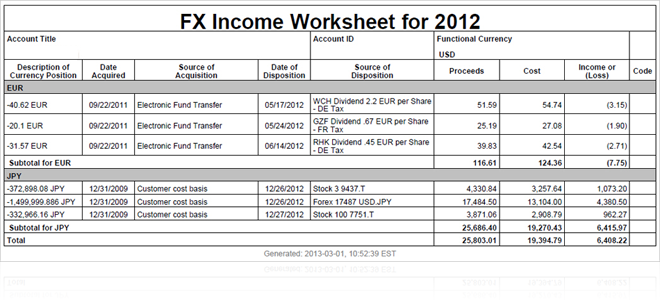

Tax Information And Reporting Fx P L Interactive Brokers

Tax Information And Reporting Fx P L Interactive Brokers

Day Trading Taxes How Profits On Trading Are Taxed

Day Trading Taxes How Profits On Trading Are Taxed

Forex Trading In Alberta Canada Forex4noobs

Forex Trading In Alberta Canada Forex4noobs

Tax Tips For The Individual Forex Trader

Tax Tips For The Individual Forex Trader

Realistic Forex Income Goals For Trading Trading Strategy Guides

Realistic Forex Income Goals For Trading Trading Strategy Guides

Forex Trading Plan Excel Forex Trading Accounting Business How

Forex Trading Plan Excel Forex Trading Accounting Business How

Forex Trading Canada 2019 S Best Canadian Brokers

Forex Trading Canada 2019 S Best Canadian Brokers

Blog Greentradertax

Blog Greentradertax

Calameo Your Questions About Trading Forex As A Business

Calameo Your Questions About Trading Forex As A Business

Canada Personal Income Tax Rate 2019 Data Chart Calendar

Canada Personal Income Tax Rate 2019 Data Chart Calendar

Top 100 Forex Blogs Websites Newsletters To Follow In 2019

Top 100 Forex Blogs Websites Newsletters To Follow In 2019

How Real And Profitable Is Forex Trading The Manila Times

How Real And Profitable Is Forex Trading The Manila Times