Forex Strategies Indicators

Exit Strategy 6 Tight Stop Timing With Cci Forex Strategies

If youre into online trading and watching the market everyday youre part of a growing number of canadians who are managing their own investment portfolios. Yes forex is not treated as lottery unfortunately you have to pay taxes on all the income that you make on currency exchange it is still a grey area and there is not specific line number to enter your income but officially you should post your forex income under other income field when you do your income tax return.

Corporate Income Taxes In Canada Revenue Rates And Rationale

Corporate Income Taxes In Canada Revenue Rates And Rationale

Forex trading income tax canada. Canadian tax laws on currency trading are another topic of interest. The problem though is sifting through the cacophony of information within the canada revenue agency to find out the applicable rules. A day trader is a person who makes his living buying selling and managing these transactions.

Forex income tax canada on sale. I would like recommend that you check the purchase price to get a cheap price or large amount. Forex options and futures are grouped in what is known as irc section 1256 contractsthese irs sanctioned contracts give traders a lower 6040 tax consideration meaning that 60 of gains or.

Basically forex trading can be treated as either income or capital gain tax in canada surprise. If sole propr! ietor does one have to register as a business. Taxes in canada! is generally simple to do.

How should i report my online trading income. Order your personal forex income tax canada from this point. As a sole proprietor a corp or individually.

What would be the best way to trade. Forex income tax canada on sale. Anyone already making a living trading forex and has tax experience please answer.

If investing is starting to become more lucrative than your full time gig you might be opting to work from home and have. With some assets its pretty clear cut as to whether they will be treated as income or capital gains. We have more info about detail specification customer reviews and comparison price.

Or is it better to incorporate. I want recommend that you always check the cost to get a cheap price or large amount. Weve more information about detail specification customer reviews and comparison price.

Ive copy and pasted a couple of ! relevant excerpts from the 2010 cra income tax interpretation bulletin for the record. However the 2010 cra income tax interpretation bulletin makes it clear that forex trading taxes in canada can be either. For those who are seeking forex income tax canada review.

These highly liquid stocks are defined by the investment industry regulatory organization of canada as securities that trade more than 100 times a day with a trading value of 1 million. For many who are searching for forex income tax canada review.

The trading interface of the demo account is similar to that of a real account. The market trends are a simulation of a real market scenario.

Free Demo Binary Options Account No Deposit Minikuechen Info

Free Demo Binary Options Account No Deposit Minikuechen Info

Forex binary trading demo account. For example you can find demo accounts for stock trading in singapore as easily as you can in south africa. They give you the o! pportunity to actively engage in forex trading helping you to gain knowledge about how the market works how to read tables and follow trends and implement your own strategies. With a no deposit demo account you can make trades using real time market data.

Get live buy and sell prices 50k of virtual money and access to trading 245. They are not the actual trends of the real global financial market though. Open an fxcm forex and cfd demo account and practice forex trading risk free.

A binary options demo account is the best way to practice binary options trading. Though many still understand the basics of trading currency pairs and how their rates fluctuate. You can find plenty of free day trading demo accounts for binary options and cryptocurrency to forex and stocks.

Your losses can exceed your initial deposit and you do not own or have any interest in the underlying asset. At cfds are complex instruments and! come with a high risk of losing money. This means you can lea! rn how to trade and develop a winning strategy before using real money.

Trading binary options may not be suitable for everyone so please ensure that you fully understand the risks involved. Forex demo accounts allow you to practice forex trading without risking real money. Open an fxcm forex and cfd demo account and practice forex trading risk free.

This ensures that the strategies you use in live trading yields profit. A binary demo account is a practice account on which a trader uses fake money in order to learn how to trade. Forex trading involves significant risk of loss and is not suitable for all investors.

The demo account allows you to trade with all the trading instruments offered by iq options as well. Get live buy and sell prices 50k of virtual money and access to trading 245. Location should also not deter you.

He however also does not have a chance to generate any profit. D! emo trading is the best way to practice forex trading without risking real money. When using a binary demo account the trader does not risk losing his own funds.

You can trade binary with indices stocks cryptocurrencies currency pairs commodities forex and many other instruments.

Forex trading tax laws in the uk are in line with rules around other instruments despite you buying and selling foreign currency. However there remains one relatively new asset where the tax laws remain grey.

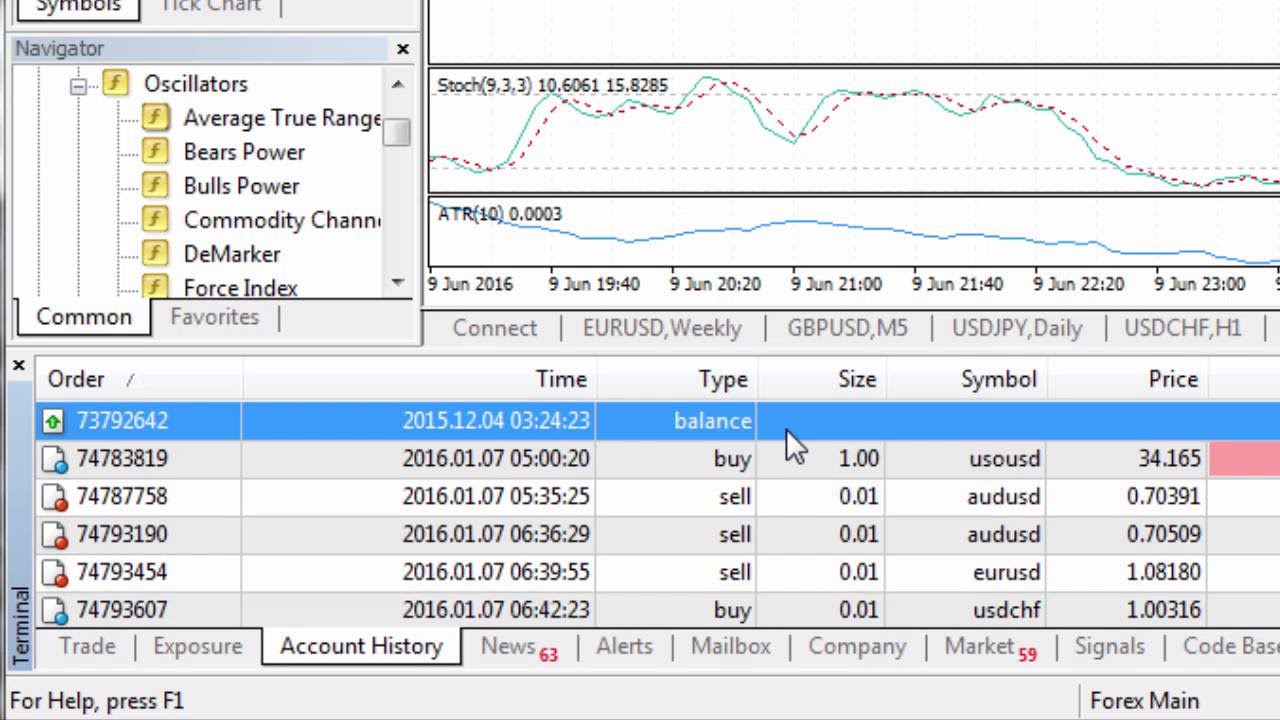

Mt4 Tips How To View Trade History Statements And Accounts For Taxation In Metatrader 4

Mt4 Tips How To View Trade History Statements And Accounts For Taxation In Metatrader 4

Forex trading tax return. Realistic returns for a forex trader reading time. Forex options trading allows currency traders to realize gains or hedge positions of trading without having to purchase the underlying currency pair. Remember you will only pay tax on the income from trading and not from money which just sits in the account earning interest.

Im an australian resident for tax purposes i also have a full time job out on the mines in the nt. 5 minutes weve all heard stories of a person who perhaps came from a lower class background who began trading and was able to achieve success earning millions in the process. Cfds stocks forex and futures trading tax in australia all falls under the same guidelines for the most part.

! However if you remain unsure about tax laws surrounding yo! ur specific instrument seek professional tax advice. Hi at faysalk88 generally speaking if you are conducting your activities outside of australia and are not a resident for tax purposes then you are not required to report non australian sourced income in an australian tax return. Hi ato im a forex trader that has just gotten into a live trading account.

That interest would be subject to tax but only if it is greater than r22 800 per year.

SUBCRIBE VIA EMAIL